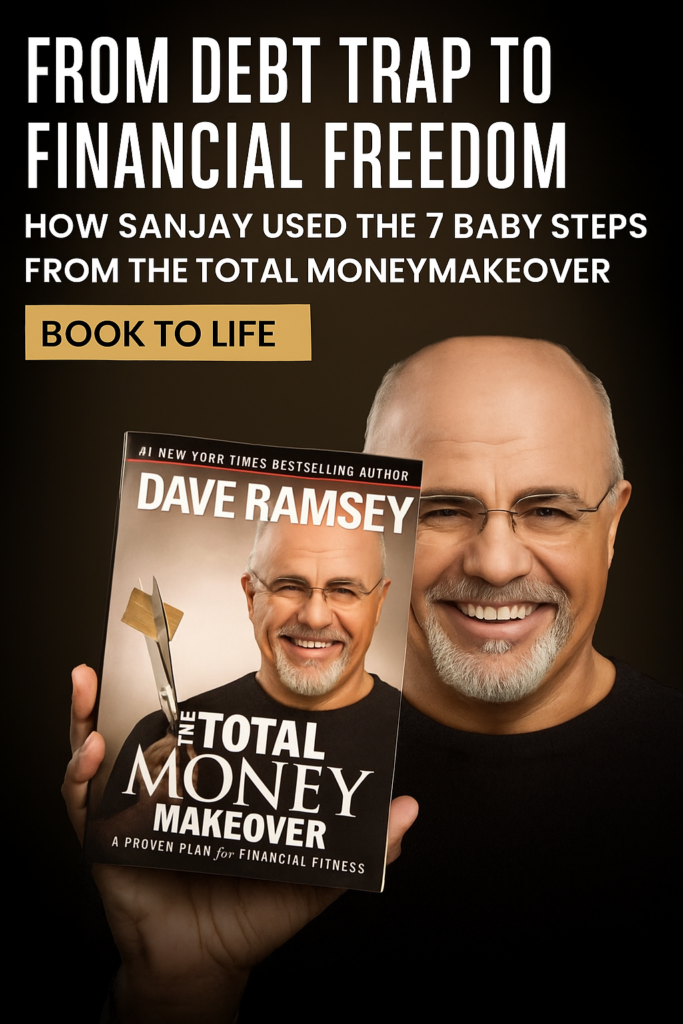

From Debt Trap to Financial Freedom: How Sanjay Used the 7 Baby Steps from The Total Money Makeover

Sanjay sat in his small Pune apartment, staring at his laptop screen. The numbers in his bank account told a painful truth—he was living paycheck to paycheck.

Despite earning a decent salary in a multinational company, his debts, credit card bills, and EMIs swallowed most of his income.

Like many in India’s corporate world, Sanjay was earning well but living poorly—financially insecure, stressed, and one unexpected emergency away from disaster.

That was until a friend handed him a copy of The Total Money Makeover by Dave Ramsey. “Read this. If you apply what’s inside, your life will change,” his friend said.

At first, Sanjay was skeptical. But the book’s promise of financial freedom through 7 Baby Steps intrigued him. And so, his journey began.

Step 1: Build Your Emergency Starter Fund

Dave Ramsey’s first rule was simple—before you tackle debt or invest, save ₹85,000 (about $1,000) as an emergency starter fund.

Sanjay thought, “But I already have investments in stocks and mutual funds.”

The book explained: an emergency fund should be liquid and accessible, not tied up in volatile investments.

He began cutting unnecessary expenses—no more eating out five times a week, no impulsive gadget buys. In three months, he had ₹85,000 safely tucked away in a savings account.

Real-life impact: When his bike broke down unexpectedly, instead of swiping a credit card, he calmly paid for repairs from the fund—no stress, no debt.

Step 2 & Step 3: Pay Off Debt + Fully Fund the Emergency Fund

Sanjay had:

-

Credit card debt of ₹60,000

-

Personal loan of ₹1,80,000

-

Education loan of ₹2,50,000

Dave Ramsey recommended the Debt Snowball Method—pay off the smallest debt first for motivation, then roll that payment into the next biggest debt.

Sanjay’s plan:

-

Pay off ₹60,000 credit card first.

-

Then attack personal loan.

-

Finally, clear education loan.

In 14 months, Sanjay was debt-free except for his home loan.

Next, he expanded his emergency fund to cover six months of expenses—₹3,00,000 in liquid mutual funds and savings.

Step 4: Invest 15% of Income for Retirement

With no debt dragging him down, Sanjay redirected 15% of his monthly income into retirement investments.

His allocation followed Ramsey’s guidelines:

-

25% in large-cap equity mutual funds

-

25% in aggressive growth funds

-

25% in international mutual funds

-

25% in hybrid funds for stability

Result: Within 2 years, his portfolio began compounding significantly—he saw the magic of starting early.

Step 5: Plan for Children’s Education

Although Sanjay was single when he began, he planned ahead. He opened a SIP in an equity mutual fund with a goal of funding his future child’s college education.

By starting early, the power of compounding meant he would need to contribute far less over time compared to starting late.

Step 6: Pay Off the Home Loan Early

Dave Ramsey’s advice was clear—don’t keep big loans hanging over your head.

Sanjay had a 20-year home loan, but he began making extra EMI payments every quarter.

By the 12th year, he had cleared the entire loan—8 years early.

Step 7: Build Wealth & Give Back

Debt-free, with solid investments and an emergency fund, Sanjay entered the wealth-building phase.

He diversified into:

-

Rental property investments

-

Dividend-yielding stocks

-

A small equity in a friend’s start-up

And he began giving back—sponsoring education for two underprivileged children and contributing to healthcare charities.

Sanjay’s reflection:

“I thought financial freedom was only for the rich. But it’s for anyone willing to follow the steps and stay disciplined.”

Takeaways for Readers

From Sanjay’s story, here’s what you can apply right now:

-

Always start with a liquid emergency fund—it’s your financial safety net.

-

Attack debt with the Debt Snowball Method to stay motivated.

-

Invest early, even if the amount is small.

-

Don’t skip steps—each baby step builds on the previous one.

Final Words

Sanjay’s transformation from financially trapped to financially free wasn’t overnight—it took patience, discipline, and a plan.

But with the 7 Baby Steps from The Total Money Makeover, he built a life where money no longer controlled him—he controlled his money.

Ready to Start Your Financial Makeover?

Don’t just read about financial freedom—take action today. Your future wealth and peace of mind depend on the choices you make now.

📞 Call MyCashFlow Today: +91-8850511869

🌐 Visit us: www.mycashflow.in

Let’s work together to create your own Total Money Makeover and achieve the life you’ve always dreamed of—debt-free, financially fit, and truly free.