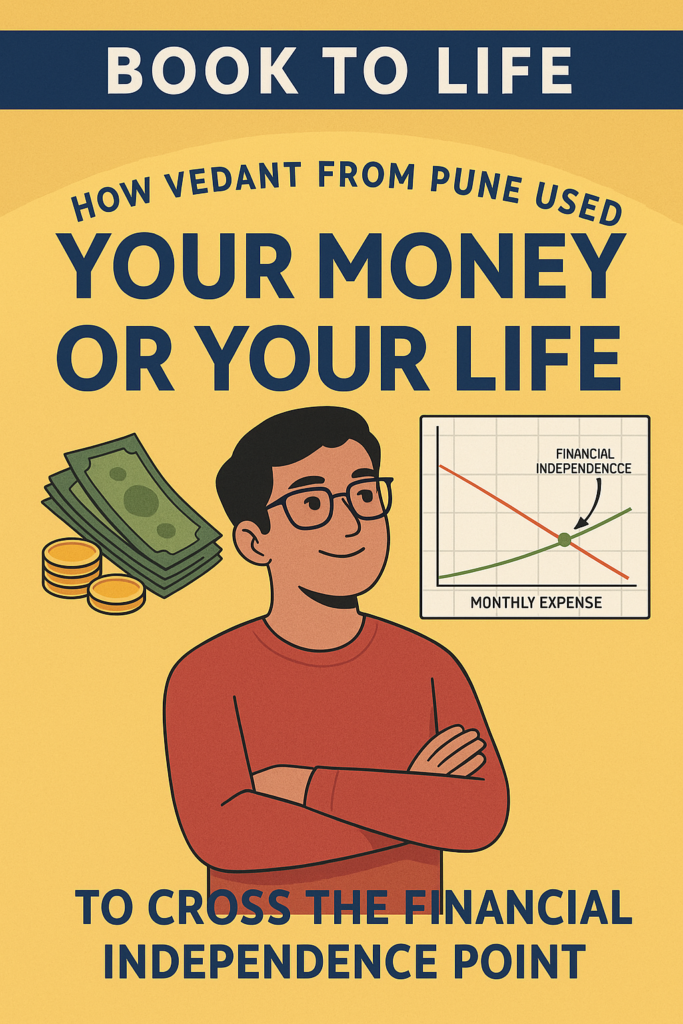

1. Hook: The Day Vedant Realized He Wasn’t Living, Just Earning

It was 11:45 PM on a Friday night in Pune.

Vedant sat in his darkened one-bedroom apartment, laptop open, eyes fixed on yet another “urgent” client email. His salary was decent, his job stable, but his life? A blur of deadlines, EMI payments, and late-night takeout.

He earned more than he had five years ago, yet his savings account still hovered near zero. The irony wasn’t lost on him—he was working harder than ever, but had nothing to show for it except a new phone, a bigger TV, and a credit card bill that made his stomach drop every month.

One line from his own journal haunted him:

“I’m living to work, not working to live.”

2. The Turning Point: A Coffee Conversation That Changed Everything

The shift began in the most ordinary way—a coffee with his old college friend Ananya. She looked relaxed, happier than he remembered. When he asked about her job, she smiled and said,

“I quit six months ago. I’m living off my investments now.”

Vedant laughed, thinking she was joking. But she pulled out a notebook and began showing him how she had achieved something called the crossover point—where her passive income exceeded her monthly expenses.

Her secret? The book Your Money or Your Life by Vicki Robin. She insisted Vedant read it. That night, he ordered a copy.

3. Implementation Phase: Applying Your Money or Your Life

The first few chapters hit Vedant like a freight train. This wasn’t another “get rich quick” guide—this was a philosophy shift. He decided to follow the nine steps in the book exactly, documenting every move.

Step 1: Calculate Your Real Net Worth & True Hourly Wage

Vedant started by calculating his net worth. He listed every asset—bank accounts, mutual funds, even his scooter—and subtracted his liabilities (loans, credit card balances).

Then came the eye-opener: calculating his true hourly wage. After factoring in commuting, unpaid overtime, and work-related expenses, he realized his ₹80,000 monthly salary was actually worth closer to ₹400 per hour, not ₹500. That realization made him question every purchase.

Step 2: Track Every Rupee

For the first time, Vedant kept a detailed monthly tabulation of every expense. He used a simple spreadsheet:

-

Rent: ₹15,000

-

Food & Dining: ₹8,000

-

Transport: ₹3,500

-

Subscriptions: ₹1,200

-

Impulse Shopping: ₹6,500

-

Miscellaneous: ₹4,000

It wasn’t about guilt—it was about awareness. “When you see your money flow, you see your life energy flow,” the book said.

Step 3: Ask the Three Transformative Questions

For every expense, he asked:

-

Did this bring me satisfaction?

-

Did it improve my quality of life?

-

Would I still spend on this if I didn’t have to earn money?

He found that 70% of his impulse shopping failed all three questions.

Step 4: Create the Income & Expense Graph

This visual was a game-changer. Each month, he plotted his total income and expenses. His goal? Make the expense line dip below the passive income line.

Step 5: Redefine Work

Vedant stopped thinking of work as a life sentence. Instead, it was a means to fuel his financial independence fund. He cut down on overtime and started a side hustle tutoring college students online.

Step 6: Build the Freedom Fund

Instead of upgrading his scooter, Vedant invested in index funds and a recurring deposit. Every rupee saved went into assets that generated passive income.

Step 7: Focus on the Crossover Point

Month after month, his expense line dropped while his investment income rose. The day his passive income touched ₹24,000—slightly above his monthly expenses—he knew he had hit the crossover point.

4. The Breakthrough: The Day Vedant Fired His Alarm Clock

It happened in October. Vedant realized he could choose if and when he wanted to work. No more desperation, no more living paycheck to paycheck.

That morning, he didn’t set his alarm. He woke naturally, brewed coffee, and spent the day designing an online course on personal finance. It wasn’t just about the money anymore—it was about freedom of time.

5. Life After Change: A Richer Definition of Wealth

Today, Vedant lives in the same modest apartment but works only 20 hours a week on projects he enjoys. He travels during off-peak seasons, spends more time with his parents, and volunteers at a local NGO teaching financial literacy.

He still tracks his expenses and watches his graph climb, but now, the numbers are a reflection of conscious living, not deprivation.

6. Reflection: Vedant’s Advice to Anyone Feeling Stuck

“Your job is just one part of your life, not the whole thing. Once you see money as life energy, you start valuing both differently. You don’t need to earn millions—you just need to align your expenses with your values and build income streams that set you free.”

7. Call to Action: Your Turn to Find Freedom

Inspired by Vedant’s journey? This is just one story in our Book to Life series. Pick up Your Money or Your Life by Vicki Robin today and take the first step toward your own transformation. Your crossover point might be closer than you think.