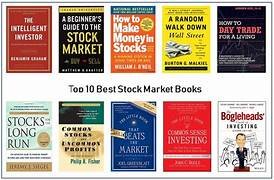

Investing in the stock market can be a daunting task, especially for beginners. The key to successful investing is knowledge, and there’s no better way to learn than by reading books written by industry experts and seasoned investors. Here’s a list of the top 10 must-read books on the stock market that will equip you with insights, strategies, and timeless advice to navigate the financial markets.

1. The Intelligent Investor by Benjamin Graham

Considered the bible of value investing, The Intelligent Investor emphasizes long-term investment strategies, teaching readers how to invest wisely, avoid common pitfalls, and create a margin of safety. Warren Buffett calls it “the best book on investing ever written.”

2. Common Stocks and Uncommon Profits by Philip Fisher

Philip Fisher’s Common Stocks and Uncommon Profits offers deep insights into qualitative analysis, focusing on how to pick companies with strong growth potential. Fisher’s emphasis on management quality and innovation is still highly relevant today.

3. One Up On Wall Street by Peter Lynch

In One Up On Wall Street, Peter Lynch, one of the most successful mutual fund managers, teaches investors how to leverage their knowledge and experience to find stock market opportunities. He famously encourages investors to “invest in what you know.”

4. A Random Walk Down Wall Street by Burton G. Malkiel

This book popularizes the concept of the efficient market hypothesis (EMH) and argues that stock prices are largely unpredictable. Malkiel advocates for low-cost index funds and long-term investing as the best ways to grow wealth over time.

5. The Little Book That Still Beats the Market by Joel Greenblatt

Joel Greenblatt presents a simple, yet powerful formula for stock picking in The Little Book That Still Beats the Market. The book explains how to identify undervalued stocks with a high potential for returns using Greenblatt’s “magic formula.”

6. Market Wizards by Jack D. Schwager

Market Wizards offers a series of interviews with some of the greatest traders of all time. This book provides valuable insights into their strategies, psychology, and decision-making processes, making it an excellent resource for aspiring traders.

7. Reminiscences of a Stock Operator by Edwin Lefèvre

This classic follows the life and career of legendary stock trader Jesse Livermore. Reminiscences of a Stock Operator gives readers an inside look at the ups and downs of speculative trading and provides timeless lessons on market psychology and discipline.

8. The Little Book of Common Sense Investing by John C. Bogle

John Bogle, the founder of Vanguard and the pioneer of index funds, presents a simple yet effective case for low-cost investing in The Little Book of Common Sense Investing. Bogle argues that low-cost index funds consistently outperform actively managed funds over time.

9. How to Make Money in Stocks by William J. O’Neil

In this book, William O’Neil introduces the CAN SLIM strategy, which combines both fundamental and technical analysis to help investors identify winning stocks. How to Make Money in Stocks is highly recommended for both beginners and experienced investors looking to refine their strategies.

10. The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett and Lawrence Cunningham

This collection of Warren Buffett’s letters to Berkshire Hathaway shareholders is packed with investment wisdom. The Essays of Warren Buffett covers various topics, including business principles, corporate governance, and investment philosophy, making it a valuable resource for serious investors.

Conclusion:

Whether you’re a beginner trying to understand the basics or a seasoned investor looking to sharpen your skills, these books offer invaluable lessons on stock market investing. By learning from the experiences and insights of successful investors, you can build a strong foundation, improve your strategies, and ultimately achieve your financial goals.