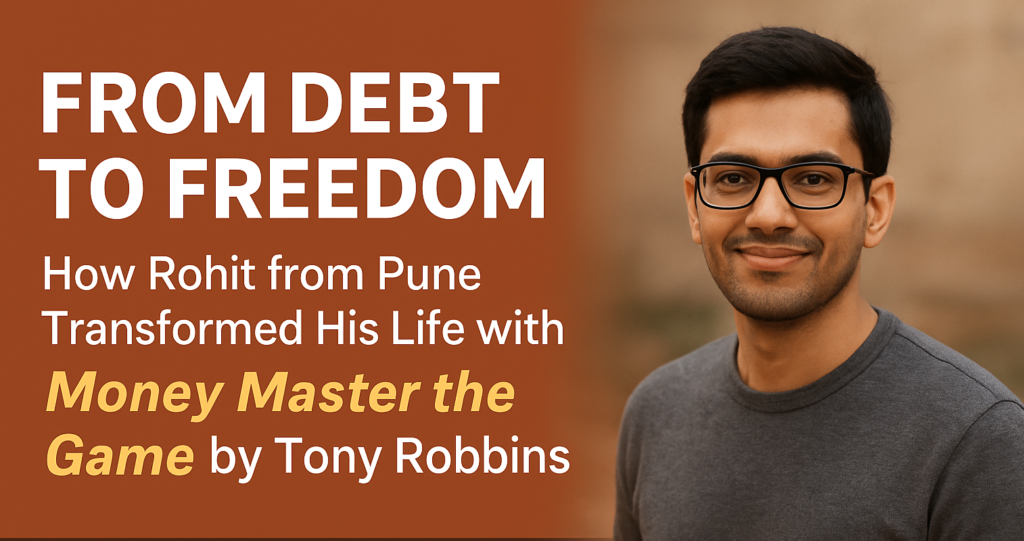

Life Before the Breakthrough

Rohit, a 32-year-old IT professional from Pune, looked at the SMS notification on his phone: “Your salary has been credited.” For a moment, relief washed over him. But within an hour, that money was gone—EMIs, credit card bills, rent, and daily expenses swallowed it whole.

Every month was the same cycle: work long hours, wait for payday, pay debts, and end up with nothing. He dreamed of starting his own digital consultancy, traveling the world, maybe even buying a house for his parents. But in reality? He was trapped—living paycheck to paycheck, afraid of unexpected medical bills, and constantly anxious about money.

“Is this all life has to offer? Work until I’m 60 and hope there’s something left?” he thought.

Rohit’s story mirrors millions of young professionals—ambitious but caught in the endless treadmill of money worries.

The Turning Point: A Book That Changed Everything

One rainy evening, while scrolling aimlessly through YouTube, Rohit stumbled upon an interview with Tony Robbins. The title struck him: “You either master money, or money masters you.”

The words hit home. Rohit felt like money had been controlling his every move—deciding what he could eat, where he could travel, even whether he could say “yes” to opportunities.

He ordered Robbins’ book, Money: Master the Game. With a cup of chai in hand, he began reading—and within the first few chapters, something shifted.

Implementation Phase: Applying the 7 Steps

Rohit decided this book wasn’t going to be just theory. He would live it. Step by step, he began applying Robbins’ principles to his life.

Step 1: Tap the Power of Compounding

Robbins emphasized that the most important financial decision is when you start investing, not how much.

Rohit calculated: If he saved just ₹5,000 per month in a simple index fund earning 10% annually, he could accumulate more than ₹1.5 crore in 25 years.

He remembered Robbins’ story of William and James—the one who started early ended up with 600% more wealth. That was the spark.

💡 Action he took: He cut down on weekend dine-outs and redirected that money into SIPs. It was small, but consistent.

Step 2: Know the Rules Before You Play the Game

Robbins warned about brokers and hidden fees. Rohit realized that many of his existing mutual funds were eating away at his wealth with high management costs.

💡 Action he took: He shifted to low-cost index funds and ETFs. He also started learning the basics of personal finance, no longer trusting every “advisor” blindly.

Step 3: Make the Game Winnable

“What’s my number?” Rohit asked himself.

He sat down with a notebook and calculated: To cover his lifestyle and support his parents, he needed ₹3 crore for true financial freedom. That was his target.

💡 Action he took: He:

-

Reduced unnecessary spending (cancelled unused subscriptions, switched to budget travel).

-

Built a side income by freelancing as a digital marketing consultant.

-

Committed to investing at least 20% of every paycheck.

Step 4: Asset Allocation – The Most Important Decision

Robbins’ interviews with billionaires highlighted that asset allocation—not timing—creates lasting wealth.

💡 Action he took: Rohit built his own “All Seasons Portfolio”:

-

30% Stocks

-

40% Bonds

-

15% Mid-term bonds

-

5% Gold

-

5% Commodities

Every six months, he rebalanced. Slowly, he felt control returning to his life.

Step 5: Creating Lifetime Income

The idea of depending only on salary terrified him. Robbins stressed building income streams that last through inflation and recessions.

💡 Action he took:

-

Invested in a small rental flat near Hinjewadi IT Park.

-

Built dividend income from stocks.

-

Grew his freelance consultancy until it generated steady monthly revenue.

Now, even if he lost his job, his life wouldn’t collapse.

Step 6: Invest Like the 0.001%

Instead of chasing hot stock tips, Rohit followed billionaire advice: keep it simple, long-term, and defensive.

💡 Action he took:

-

Used Warren Buffett’s principle: “Buy the market.” He invested regularly in ETFs.

-

Followed Paul Tudor Jones’ idea: Play defense—always have cash reserves.

-

Embraced John Bogle’s wisdom: Focus on index funds.

Step 7: Just Do It, Enjoy It, and Share It

The final step was not just about wealth—it was about fulfillment.

💡 Action he took: Rohit started mentoring younger colleagues on financial literacy. He also pledged 5% of his freelance income to support education for underprivileged kids in Pune.

The joy of giving, he realized, was the ultimate wealth.

The Breakthrough: The Moment Everything Changed

The turning point came two years later.

One morning, Rohit checked his investment portfolio and realized his net worth had crossed ₹50 lakhs—halfway to his financial freedom number. For the first time, he felt secure.

A month later, when his company announced layoffs, Rohit didn’t panic. His rental income and freelance business covered his expenses. Instead of fear, he felt freedom.

“I don’t work for money anymore. Money works for me,” he thought, smiling.

Life After Change

Today, at 38, Rohit lives a life he once thought impossible:

-

Runs his own thriving digital consultancy.

-

Owns two rental properties providing passive income.

-

Travels every year—his dream trip to Europe finally became reality.

-

Provides financial support for his parents with pride.

-

Actively contributes to a local NGO focused on children’s education.

Most importantly, he is no longer chained by fear. Money is now his servant, not his master.

Reflection: Lessons Rohit Learned

In his own words:

“Tony Robbins’ Money: Master the Game didn’t just change my finances—it changed my mindset. I learned that financial freedom isn’t about being a millionaire; it’s about having control, security, and the freedom to live on your terms. Start early, invest smart, diversify, and never stop learning.”

Call to Action

Inspired by Rohit’s journey? This is just one story in our Book to Life series.

Tony Robbins’ Money: Master the Game has transformed millions of lives—and it can transform yours too.

👉 Start your own journey toward financial freedom today. Visit MYCASHFLOW or call 885051169 to take the first step.

Disclaimer

This story is hypothetical and created only to illustrate how one might apply the principles of Money: Master the Game by Tony Robbins in real life.