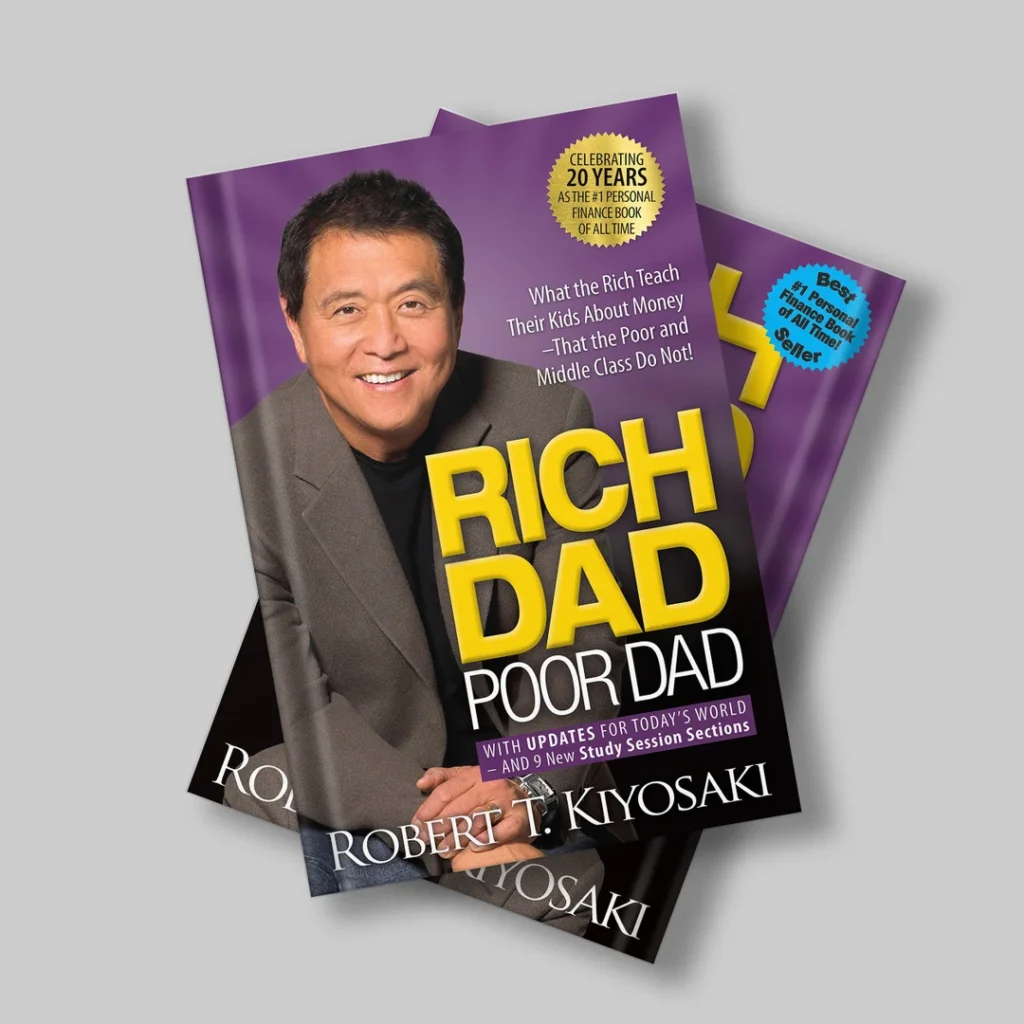

Rich Dad Poor Dad is more than just a book. It’s a mindset shift. Robert Kiyosaki, the author, didn’t just write about finance; he exposed the huge difference between how the rich and the middle class think about money.

This blog brings you the essence of the book chapter-by-chapter, along with real-life examples and practical lessons you can apply right now.

Chapter 1: Rich People Don’t Work for Money

Kiyosaki reveals how the rich teach their children to take risks and embrace discomfort for growth. While poor and middle-class families often tell their kids to “study hard and get a safe job,” rich parents teach them to look for opportunities and solve problems.

Real-Life Example: Elon Musk didn’t wait for a job; he created companies like Zip2, PayPal, and then Tesla. He took massive risks and created his own income engines.

Chapter 2: The Poor and Middle Class Work for Money; the Rich Make Money Work for Them

Middle-class people earn, spend, and repeat in a rat race. Rich people build income streams. They invest in things that generate income, such as real estate, stocks, or businesses.

Real-Life Example: A businessman buys an apartment, puts it on rent, and earns monthly passive income. Meanwhile, a middle-class person buys a car on EMI and keeps working just to pay off debt.

Chapter 3: Why Teach Financial Literacy

Knowing how to read a balance sheet is more important than a degree in many cases. The rich understand the difference between assets and liabilities.

Assets: Put money in your pocket (e.g., rental property)

Liabilities: Take money from your pocket (e.g., EMI on self-occupied home)

Real-Life Example: Ramesh took a home loan and now pays EMI + property tax + maintenance. His home is a liability. On the other hand, Suresh bought a small shop and rented it – it’s an asset.

Chapter 4: A Long-Term Strategy That Leads to Wealth

Don’t buy liabilities first. First, build assets and then enjoy luxuries. This is the secret of delayed gratification.

Real-Life Example: A software engineer invested in stocks and mutual funds from age 25. By 35, he had enough cash flow to buy his dream car without any loan.

Chapter 5: Mind Your Own Business

Don’t only work for someone else’s dream. Build your own business or side hustle.

Assets to build:

Stocks

Real estate

Mutual funds

Flip products

Start an online business

Real-Life Example: A woman started with blogging and affiliate marketing on books (just like GaneshBookMantra). Within a year, she was earning more than her job.

Chapter 6: The History of Taxes and Power of Corporations

Rich people use companies to manage their income and reduce tax.

Rich: Earn → Spend → Pay Tax

Middle Class: Earn → Pay Tax → Spend

Real-Life Example: A business owner deducts office expenses, travel, even phone bills before paying tax. A salaried person has little control.

Chapter 7: The Rich Invest Money

Rich people trust themselves, take educated risks, and constantly look for opportunities to invest.

Real-Life Example: Robert Kiyosaki invested in real estate when everyone was scared. That decision made him a multi-millionaire.

Chapter 8: Work to Learn, Not Just to Earn

The author took jobs not for money but for learning skills like sales, communication, finance, etc.

Real-Life Example: A young man worked in network marketing for 2 years and learned sales. Later, he built his own online store and became successful.

Chapter 9: Overcome Obstacles

Fear of losing money, laziness, and criticism stop most people. Rich people build habits, take action, and learn from failures.

Real-Life Example: A startup failed twice but learned from each setback. On the third try, they created a profitable e-learning platform.

Chapter 10: Getting Started

Success starts with desire, discipline, and action.

Keep your dreams strong.

Learn from books, mentors, and seminars.

Take calculated risks.

Be generous; give back to society.

Real-Life Example: Kiyosaki himself started with nothing but became wealthy by learning, applying, and sharing knowledge. He now inspires millions.

🔥 Five Powerful Takeaways:

Build assets first, then enjoy luxuries.

Don’t just work for money – make it work for you.

Learn financial literacy early.

Invest in yourself: education, skills, and mindset.

Build income-generating assets: business, rental, stocks.

🚀 Call to Action:

Are you ready to take control of your money and your future?

Start small, but start today.

📈 Follow @GaneshBookMantra for real stories and book-powered life lessons.

🌊 Explore how we help people apply book wisdom to build income: MYCASHFLOW

📄 Read more practical blogs: GaneshBookMantra.com